Learn All About Orlando Florida

There isn't another state like Florida. Life is just different out here. We'll be your guide. Learn all about Living In Orlando.

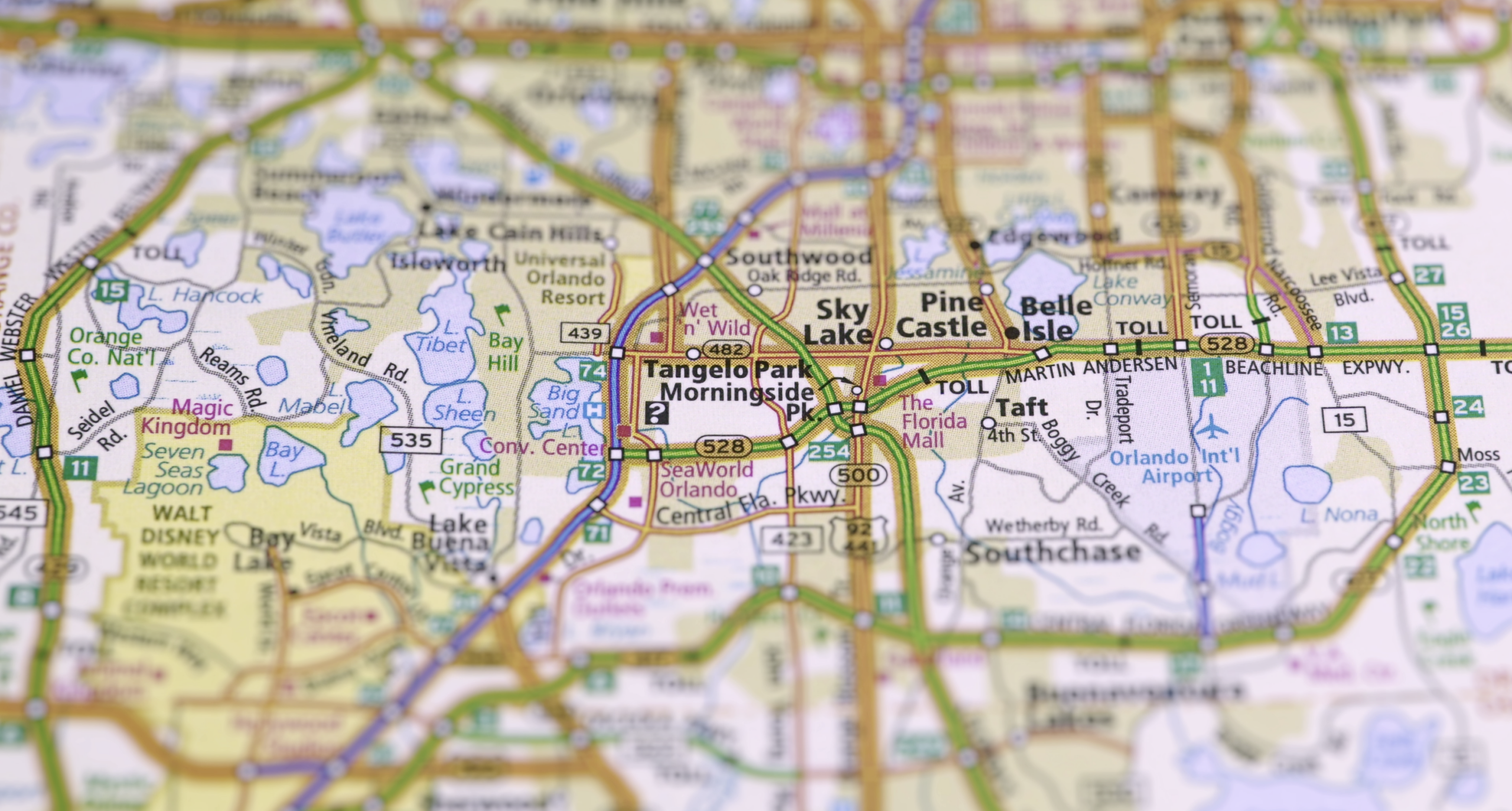

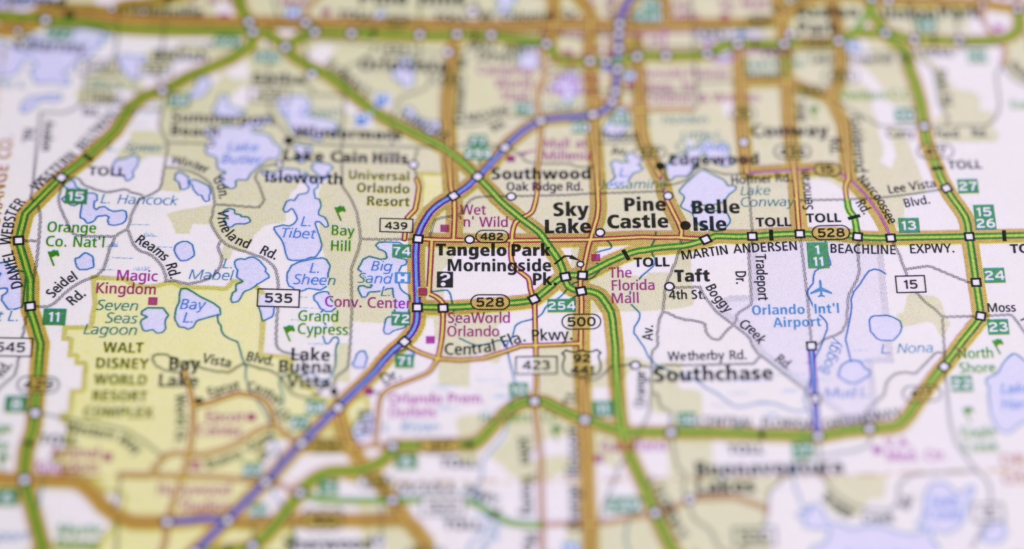

Neighborhood Guide

Relocating to Orlando and not sure where to start? We got your back. Learn all about neighborhoods in Orlando.

Orlando Homes Search

Homes in Orlando are not your typical homes. The design and style of living in paradise goes into each home.

Pros And Cons of Living In Orlando

Moving To Paradise

I want to help make your move to Florida the smoothest transition possible. After all, this will be one of the biggest moves of your life. Orlando accommodates all walks of life. Learn more about whether Orlandi is where you should consider living. Whether you are looking to rent, buy, or invest I am here to help.

Discover Where To Live In Orlando

Click below to learn more about the area and if it is a good fit for your lifestyle.

YOUR LOCAL AGENT

Cameron Hodge is your local real estate agent and guide to Orlando, Florida. My family and I moved here after wanting a better life for our children, Orlando is now our home and I help others make the move to this amazing place we call home. I also have prior military service with the United States Marine Corps. Having grown up in NY state, stationed in CA and other places around the world I help people from all around the world move to Orlando, and I absolutely love it.

All About Living In Orlando, Florida

Advice on making the move, real estate, and more.

---